Corporates

Financial literacy is nothing but knowledge about personal management of finances. It gives you the twin benefit of protecting you from financial fraud as well as planning for a financially secure future. Unless the common person becomes informed and literate about the changes in the financial markets and products and protects himself from financial distress, especially after the pandemic of COVID - 19, wealth creation for the common man and the economy will remain a distant dream.

Financial Literacy is the key that unlocks the value of all other benefits that the employer is providing. It results in a much more engaged, much more productive and much happier workforce. One such attempt is made by Finsaarthi Learning Solutions by conducting the Financial Literacy & Investor awareness programs for corporates at all levels as part of their Employee Engagement Program.

FAQs

Type & Number of Participants

Generally, we conduct sessions for a group size of a minimum of 15 and a maximum of 100 online and 250 offline employees.Mode of Training

Offline and Online (Blended Learning).Duration

The session is conducted for a minimum of 1 hour and a maximum of 3 hours depending on the topic and content to be covered.We cover the following topics for the students.

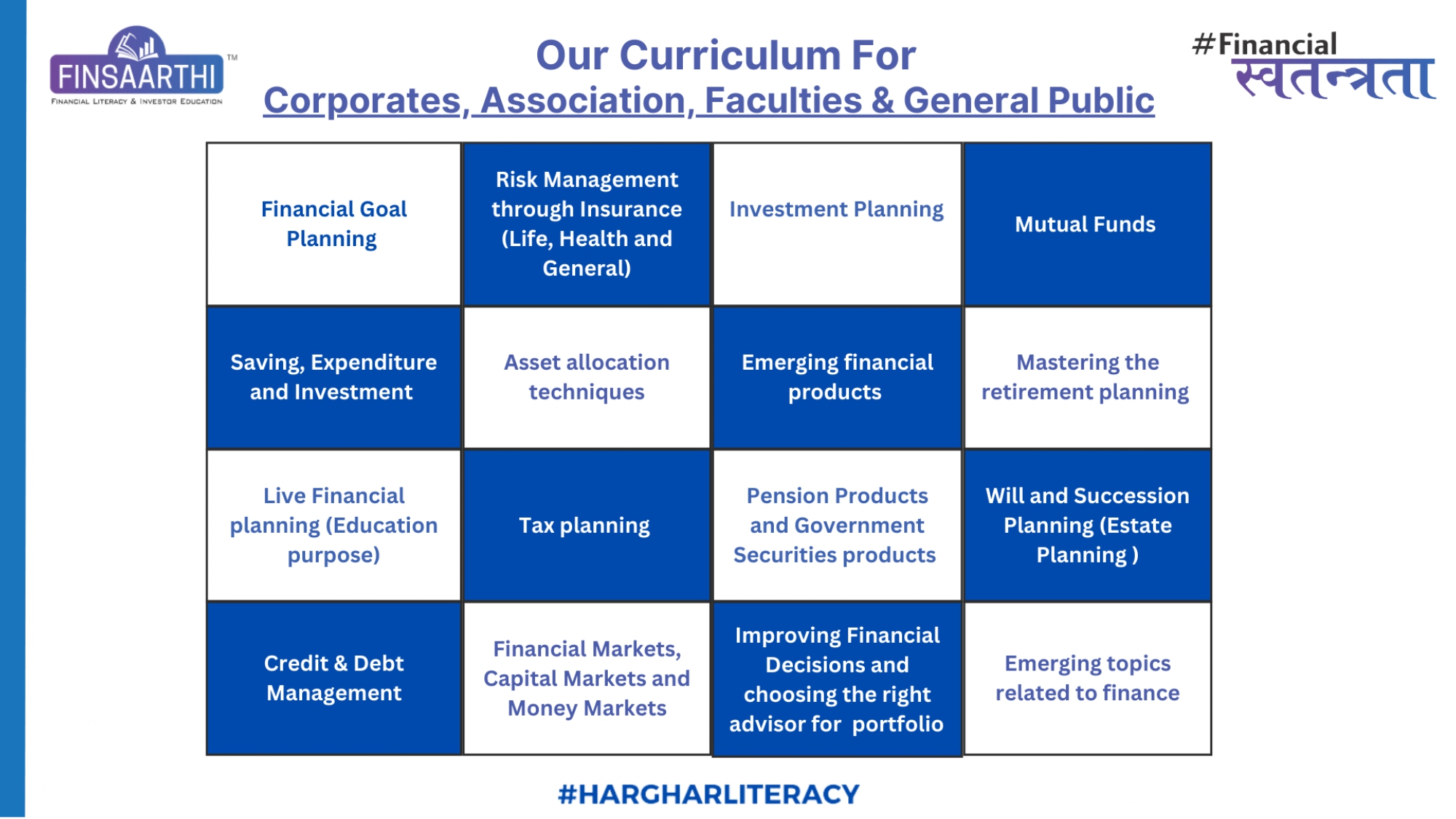

- Financial Goal Planning

- Risk Management through Insurance (Life, Health and General)

- Investment Planning

- Mutual Funds

- Saving, Expenditure and Investment

- Asset allocation techniques

- Emerging financial products

- Mastering the retirement planning

- Live Financial planning (Education purpose)

- Tax planning

- Pension Products and Government Securities products

- Will and Succession Planning (Estate Planning)

- Credit & Debt Management

- Financial Markets, Capital Markets and Money Markets

- Improving Financial Decisions and how to choose the right advisor or distributor for your portfolio

- And emerging topics related to finance

- Helps build a secure financial future

- Prepared for financial emergencies

- Disciplined approach to money

- Reduces stress related to money matters

- Improve Savings and Investment

- Tax Planning

- Discuss various topics like Goal Planning, Retirement Planning, Tax Planning and Estate Planning (Will Making)

- Selection of proper Financial Advisor

- Understand the difference between Advisor and Agent

- Increase Faculty Engagement

- Helps to Develop your faculties

- Makes faculties feel valuable to the organization

- Increase Productivity and efficiency

- Improve Faculty Retention

- Enhance the college/university Brand

We cover the following topics for the students.

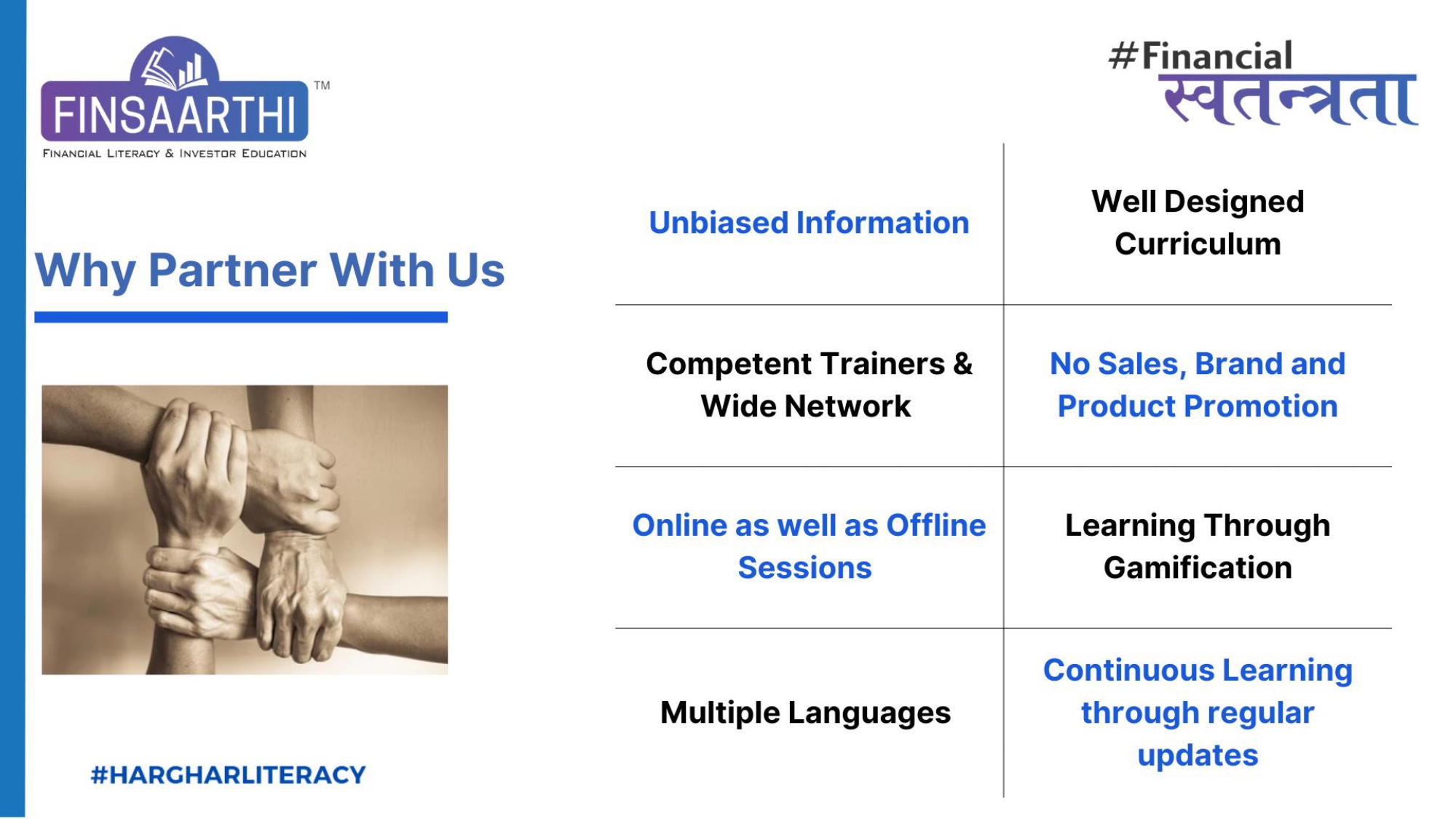

- Unbiased Information

- Easy-to-understand and well-designed curriculum

- Expert and Experienced trainers

- No Brand promotion or any product promotion

- No Vested Sales, Business Expectations and Financial Advisory

- Well-structured content for Inductees, Junior, Mid-level and Management Level

- Learning through Gamification, Quizzes and Live Case studies

- Continuous Learning through regular updates

- Online as well as Offline form

- Completely FREE sessions